“Hide your white money for a black day”, this Arabic proverb perfectly explains the situation faced by the country on the eve of 8th November when PM Narendra Modi, in his address to the nation announced the demonetization of Rs. 500 and 1000 notes currently in circulation, effective by midnight that day. He also introduced the new Rs. 500 and 2000 notes brought in place of the banned currency.

This new move by the government included measures to protect the interests of common citizens. The old notes could be deposited in bank accounts till 30 December while the Rs. 500 notes could be used for transactions in certain places till 15 December, Rs. 1000 notes could not be used for any transactions except being deposited in bank accounts.

Even though the government claims that the measure was taken to curb the menace caused by counterfeit currency used for terrorism as well as to destroy the black money in the country, this measure met with huge criticism for its mismanagement and lack of organization with our previous PM Dr. Manmohan Singh calling it a “monumental management failure” and a case of “organised loot and legalised plunder.”

Vox Populi had the opportunity to interact with Prof. Surajit Sinha of the department of Economics at IIT Kanpur. He shares his views about the step taken by the Government.

“We in India have a currency economy. And in such an economy holding cash is a normal practice. Everyone, be it businessmen or working professionals, have cash. And having some cash is necessary for day-to-day transactions. But the large amount of unaccounted cash that isn’t used and is stored without the knowledge of Income Tax Department can be classified as black money. The main problem with black money is that the government doesn’t get the tax revenue on the unaccounted wealth.

I think the main motive behind this move is to destroy some of the black money possessed by the people. I don’t think this measure will help in preventing the accumulation of black money in future.

But even the idea of destroying black money by demonetizing currency notes comes with an assumption that all the black money in the country exists in cash form, which is obviously not true. A lot of black money is stored in the form of investments in gold, property, etc. The value of these goods is index to inflation. So, as inflation increases, their prices increase too. Contrary to cash, the value of which may decrease with increase in inflation.

One of the reasons why property prices had been going up for the past couple of years was due to the large amount of unaccounted money flowing into the industry. For the same reason, the property prices may go down after the demonetization of currency.

In the real estate industry, making receipts of value less than the original prices of the property is a regular affair to cover up the balance money which is unaccounted.

So, if the government wants to hit black money hard, then demonetization won’t do much.

On the other hand, even demonetization doesn’t stop the generation of black money as the new currency is not going to be replaced for a long while now.

One remarkable thing about this scheme is that there is no penalty for black money holders turning in their wealth. Although there will be high tax rates on the money being deposited.

Another aspect of demonetization is the implementation of this policy and the problems caused by this.

In rural areas, most people don’t have bank accounts and the number of bank offices are less too. So the people would face a lot of difficulty in getting their notes exchanged. Even in the urban areas where the number of ATMs and bank offices is high, a lot of commotion can be seen in the lines outside bank ATMs.

The daily wage workers who get their salary on a daily basis would be facing a problem in exchanging the money possessed by them in older denominations. Because given the situation outside banks, for them standing in a queue means losing out a full day’s wage. In the case of shopkeepers, the bank is making a deviation from its limit of Rs. 4000 a day allowing them to exchange more than Rs. 4000 into new currency as they need cash for their businesses. But a business owner is not given such privileges. So, they won’t be able to pay their workers working on daily basis. A lot of people will go unpaid, especially the poor section of the society.

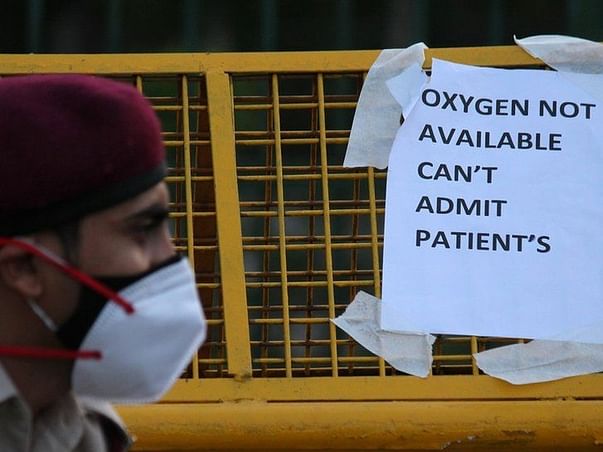

So, in the short run, along with black money holders, other people including poor people and people in urgent need of money are going to be affected.

My son, being sick, had to be hospitalized and the money I withdrew before the demonetization of currency is now worthless for the private hospital where he is admitted. There is no facility given in the banks for the people facing such emergency. I remember a daily wage worker whose wife had been admitted to a nursing home in Kalyanpur Hospital, and the bill after a week came out to be Rs. 33000, an amount quite huge for him. Even though the faculty members want to help him financially, we are facing difficulty due to shortage of cash. So, this move can bring inconvenience to people in urgent need of cash.

Now keeping these personal opinions aside, the main concern I have regarding this is that the economy would be hit hard. A cash economy like ours works on the basis of spending, because by spending, we generate income for someone and the person in turn spends the cash again, generating income. This entire process of spending will slow down tremendously ultimately affecting the country’s GDP and the real economy of the country in short run.

Even though in the long run, this would allow the RBI to have an estimate of the amount of black money destroyed by this step comparing the number of notes returned by the given deadline with the number of notes in circulation according to their database. The addition revenue generated by taxing the black money being deposited into bank accounts is also a plus point. But there are huge amounts of costs involved with this too. People are dying in hospitals because of the shortage of cash, in lines outside ATMs to withdraw cash. There is even an added cost of printing the new notes. I believe that the government must have had an estimate of cost of printing new notes and the revenue generated from tax. So, there is no net cost to the government while there is a net cost to the society in the form of Opportunity Cost. But the main goal to be achieved in long run, something the government has not been able to achieve is curbing the generation of black money. Something which requires an efficient set of guidelines and staff to implement.”

On being asked about his views on a similar ban on Rs. 1000 notes imposed in 1978 by the Morarji Desai Government, these were his remarks.

“At that time, the real value of Rs. 1000 notes was very high as compared to now. So, only a small section of the society possessed those notes and hence it was not costly to the society to demonetize those notes. At that time, the common man was not affected adversely. But now, even the poor sections of the society may possess Rs. 500 notes which poses a problem for them. Rs. 500 and 1000 notes have become a common currency for many which is why the demonetization of these notes brings high costs to the society.”

Will this affect the value of currency in the world market?

“The value of currency is basically its purchasing power. As inflation goes down, the value of currency will increase. With this measure, people will naturally purchase less bringing down the demand of the goods.This may bring down the prices of goods assuming the supply function to be the same. Just like in the property business, the property prices may go down with a lot of unaccounted money flowing out of this industry. So, in a way, the value of currency may actually go up. But the decrease in expenditure will affect the real economy hurting the GDP growth rate of the country.”

Has the government taken any preventive measure to curb the laundering of black money?

“Not many spectacular reform measures have been taken, however some small acts have been passed regarding import of gold and taxes on the same. This is done because people now would buy gold using their black money and try to convert their black money into white through assets like gold. People were buying gold even with their white money because they didn’t find confidence in spending their money or investing it elsewhere. Even the transactions in the bank have become more tedious as compared to before. If I try to withdraw a large amount of cash, the cash teller asks me to reveal my PAN card and get it verified. The system has information about all my transactions which are being monitored before verification. The government is definitely trying to reduce money laundering through the public sector.”

What do you think about the casual savings done by people which may get piled up to a limit that it may be considered as black money?

“Simple casual savings is usually done by housewives, even my wife does that. Now if these savings cross a certain limit, then the money when deposited may raise concerns. In that case, we may have to provide justification about the money. “

Anything else you would like to say about this measure?

“I would like to say that I am not against any political party, in fact I would like to say that the government is going some really good work. But the demonetization will just remove the symptoms, black money is still plundering our country like a disease.”

Written by Richeek Awasthi